Background

Danish SDG Investment Fund will contribute to fulfilling the 17 UN Sustainable Development Goals

The Danish SDG Investment Fund is a public-private partnership, which will contribute to fulfilling the 17 UN Sustainable Development Goals (SDG) through private sector investments.

The fund offers advice and risk capital for projects supporting the development in strategic sectors in developing countries. This includes climate, agribusiness and food, the financial sector, water as well as production and infrastructure.

The Danish SDG Investment Fund is thus supporting SDG 1, 2, 6, 7 and 9 in particular, which focus on poverty alleviation, ending hunger, ensuring clean water and renewable energy as well as industry, innovation and infrastructure.

At the same time the Danish SDG Investment Fund also requires companies to live up to their social responsibilities, which means that the investments will also contribute across a number of the remaining SDGs to economic growth, decent work conditions, education and health.

Five billion in capital commitments

The total capital commitment to the Danish SDG Investment Fund is close to DKK 5bn. Nearly DKK 3bn was committed by Danish pension funds and private investors. The remaining DKK 2bn was committed by IFU, including DKK 100m from the state development aid and a DKK 800m loan from the Nationalbank, guaranteed by the Danish state.

The DKK 5bn will contribute to the mobilisation of additional capital for specific investments in developing countries, and total investments are thus expected to amount to DKK 30bn once the fund is fully invested.

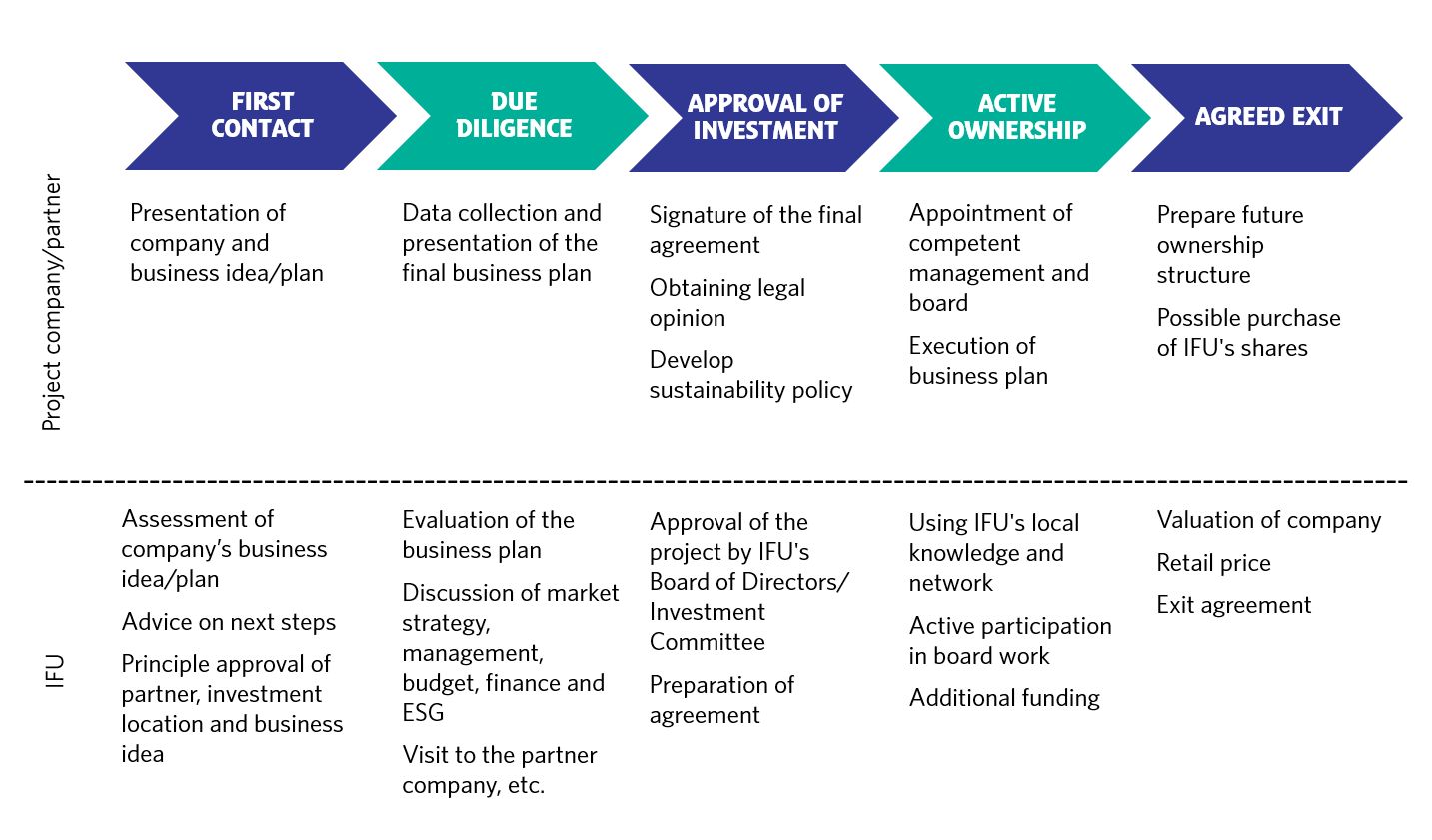

IFU is responsible

IFU is fund manager of the Danish SDG Investment Fund and is responsible for all matters, including investments, monitoring and questions. The investments must comply with IFU’s overall policies, guidelines, etc.